Income From House Property

यहाँ पर हम आपको आपकी INCOME FROM HOUSE PROPERTY जैसे की RENT INCOME ही आपकी मैं इनकम है तो उसकी CALCULATION कैसे करते है वह जानकारी यहाँ पे दी गयी INCOME TAX RULES के मुताबिक कैसे और उसमे कितना DEDUCTION मिलाता है वह जानकारी यहाँ पे दी गयी है .

How to Calculate Income from House Property

Income from house property is defined as the income earned from a property by the assessee. House property

includes the building itself and any land attached to the building.

Property refers to any building (house, office building, warehouse,

factory, hall, shop, auditorium, etc.) and/or any land attached to the

building (compound, garage, garden, car parking space, playground,

gymkhana, etc.). There are many intricacies and types of house property

which is calculated in different ways. Taxability may not necessarily be

on actual rent or income received. If the property is not let out, the

tax will be charged on the potential income the property is capable of

yielding.

Before learning how to compute income from house property, it is important to understand the terminology.

- Annual Value: This is the capacity of a property to earn income is its annual value.

- Municipal Value: This is the value of your property as evaluated by municipal authorities on which they charge municipal tax. Municipal authorities have a host of factors that they consider before assigning a municipal value.

- Fair Rental Value: The rent which a similar property with similar features in the same (or similar) area would fetch is the fair rental value.

- Standard Rent: Under the Rent Control Act, a standard rent is fixed and owners cannot receive rent higher than that specified in the Rent Control Act. This Act ensures that owners are paid fair rent, tenants are not exploited and are protected from eviction.

- Actual Rent received/receivable: This is the actual amount received by the owner from the tenant as rent, depending on who pays the water, electricity and other utility bills.

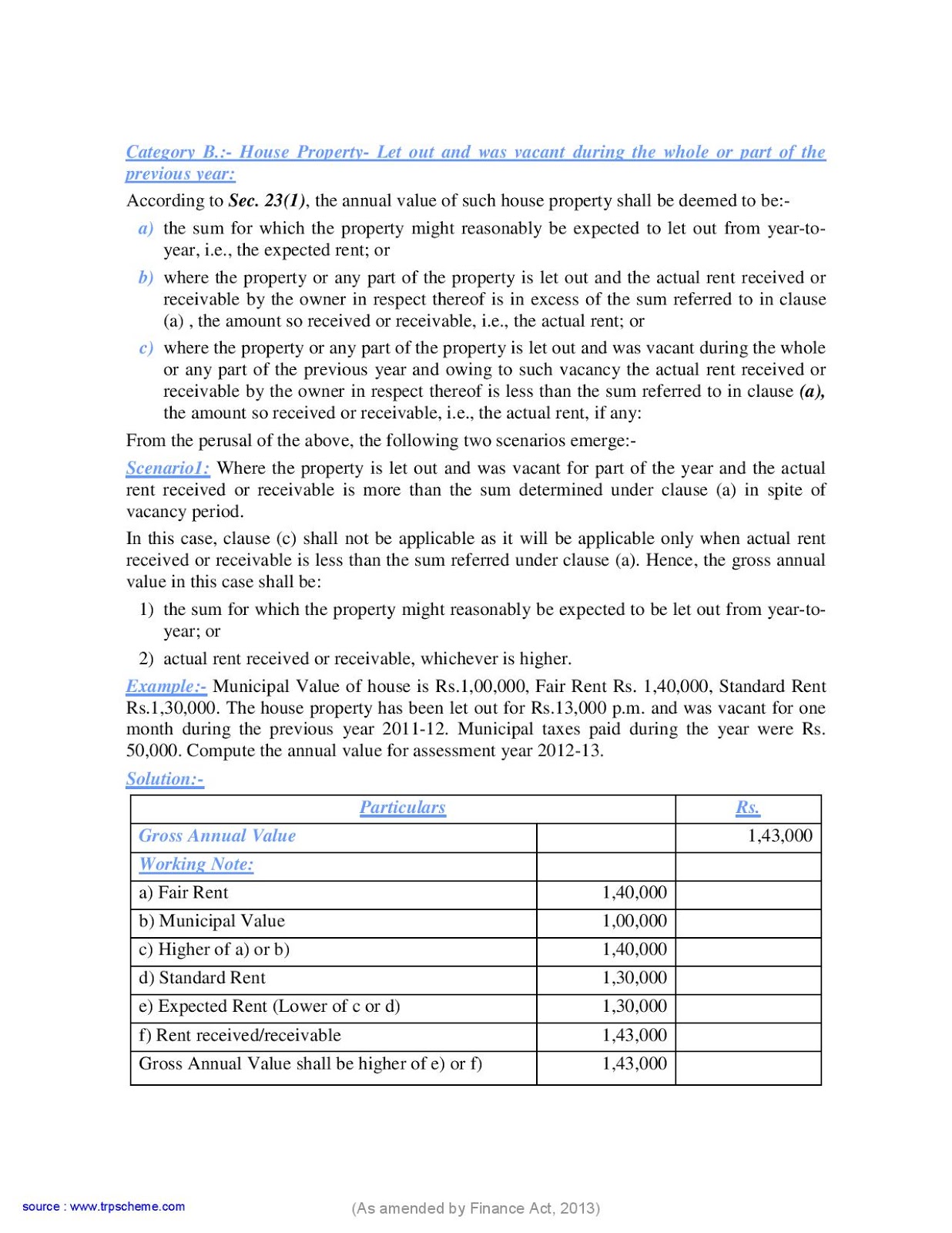

- Gross Annual Value (GAV): This is the highest among:

- Rent received or receivable

- Fair Market Value

- Municipal Valuation

If the Rent Control Act is applicable, the GAV is highest among:

- Standard Rent

- Rent Received

How to compute your income from house property.

Income from house property contains the income generated by the owned property of an individual.

Let’s assume you have a property and are charging Rs. 15,000 per

month as rent. Let’s also assume that you have paid Rs. 10,000 in

municipal taxes for that year, and have Rs. 50,000 as interest on

borrowed capital.

| Income of House Property | Amounts (in Rs.) |

| Total annual rental income value | 15,000 x 12 = 1,80,000 |

| Less: Municipal Taxes | 10,000 |

| Net Annual Value (NAV) | 1,70,000 |

| Deductions under Section 24 | |

| Standard deduction (30% of NAV) | 1,70,000 – 51,000 = 1,19,000 |

| Interest on borrowed capital (if applicable) | 50,000 |

| Income from House Property | 69,000 |

When is Annual Value “NIL”?

The annual value can be considered to be nil if the owner is residing in his property (Self-occupied property or SOP) and

does not derive financial benefit from the same. It will be nil if the

owner of the property has to move out of the city his property is in to

another city for work and resides in a rented property not owned by him.

Example: Mr. Babu, who bought a house in Bangalore has to move into a

rented place in Pune for his job. The annual value on Mr. Babu’s

Bangalore property will be nil, and he will get a tax deduction for

interest paid on borrowed capital.

How do I Save Tax on Income from House Property?

Careful planning can enable you to save a sizeable amount from

taxation. Some of the things you can do to save tax are as follows:

- Joint Home Loan – If you jointly own a property with someone and also apply for a joint home loan with your partner, you will both be eligible for tax deductions on interest up to Rs. 1,50,000 each.

- Planning a second home? If you already have one self-occupied property registered to your name and wish to avoid paying taxes on a second home, register the second property on your spouse/relatives name to avoid excess taxation.

- Joint ownership – Taxation on income from house property can be divided between co-owners, and hence lessen the load.

- Ownership of more than one property – If you own multiple properties, only one of these can be registered as your residence and fall under self-occupied property (SOP). It is important to evaluate the tax liability on all your properties and choose the one with the highest tax liability to call home, and let out the remaining. You can also change the SOP every year.

- Empty houses – that you own will still be taxed based on the fair rental value, so it’s advisable to let any and all empty properties out, enabling income and no loss because of taxation.

No comments:

Post a Comment